In the dynamic world of digital retail, one question echoes louder each year: Quick Commerce vs. E-commerce—which model defines the future? As technology evolves and consumer expectations shift, the distinction between these two business models has become crucial for entrepreneurs and established brands alike.

Quick commerce, or Q-commerce, promises lightning-fast delivery – often within 10 to 30 minutes. On the other hand, traditional e-commerce emphasizes variety, affordability, and convenience over speed. Both have strengths. But how do they compare in real-time order tracking, route optimization, or customer acquisition costs?

As customer expectations shift toward instant gratification, businesses must decide: Should they adopt the scalability of e-commerce or the speed of q-commerce? This comprehensive guide decodes the differences, compares features, and provides insights to help you decide which model aligns with your business goals.

Whether you’re planning to build an e-commerce app or considering grocery delivery app development, this blog provides actionable insights. Let’s explore Quick Commerce vs. E-commerce and uncover which business model fits your brand vision.

Market Insights: E-commerce and Quick Commerce Growth

The global e-commerce market is a behemoth, valued at $11.04 trillion in 2021 and projected to soar to $28.02 trillion by 2028, growing at a CAGR of 14.8%. E-commerce giants like Amazon, Flipkart, and Alibaba dominate this space, catering to billions of customers worldwide.

Quick commerce, though newer, is growing at an explosive pace. In India alone, the Q-commerce sector was valued at $3.34 billion in 2024, with a projected CAGR of 24.33% through 2029. Globally, Q-commerce is expected to reach $195 billion in revenue by 2025, up from $170.8 billion in 2024.

The instant grocery delivery market, a major segment of Q-commerce, was valued at $126.4 billion in 2021 and is projected to grow at a CAGR of 19% through 20306.

What is Quick Commerce? And How Q-commerce Works?

Quick Commerce, or Q-commerce, is a fast-paced retail model focused on delivering products—primarily groceries, essentials, and daily-use items—to customers within 10 to 30 minutes. It combines the convenience of e-commerce with the speed of local delivery using micro-fulfillment centers and real-time logistics technology.

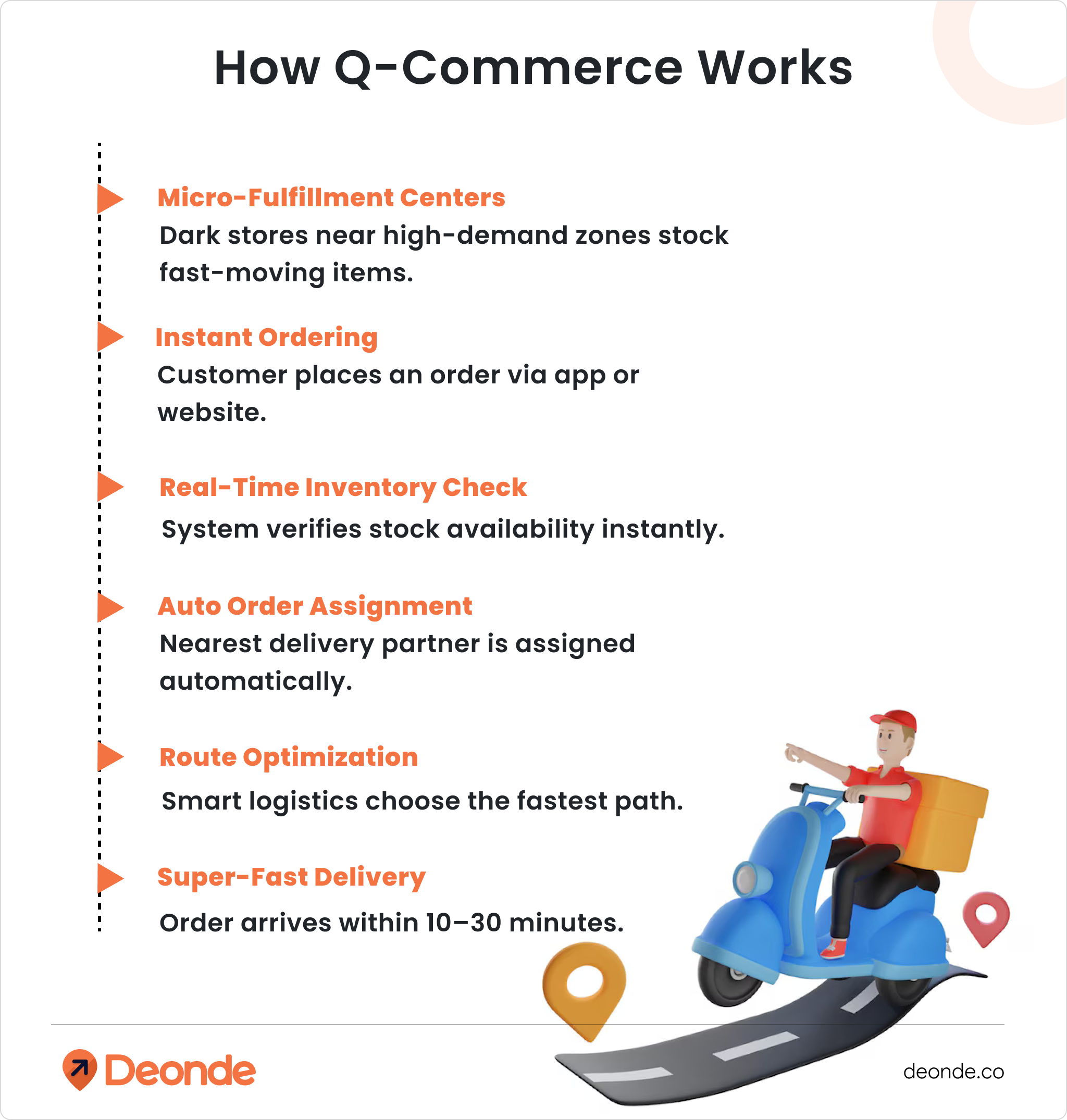

How Does Q-commerce Work?

Q-commerce operates through a network of local micro-fulfillment centers or dark stores strategically located near high-demand areas. When a customer orders via a mobile app or website, the system instantly checks real-time inventory, processes orders, and assigns a nearby delivery partner. The delivery is completed within minutes using route optimization and efficient logistics, typically between 10 and 30 minutes.

What is e-Commerce? And How e-Commerce Works?

E-commerce, or electronic commerce, is the buying and selling of goods or services using the internet. It includes everything from product listing to secure payment gateways and nationwide delivery logistics. This model has matured over the past two decades and is now the backbone of global online trade.

How e-Commerce Works?

E-commerce operates by allowing users to purchase and sell goods and/or services over the internet. Customers visit an online store or marketplace, browse products, and place orders through a digital platform. The order is then processed by the seller, who manages inventory, arranges packaging, and ships the product via a delivery service. Payment is made electronically using various methods such as credit/debit cards, digital wallets, or net banking. The entire process is supported by backend systems like inventory management, payment gateways, and logistics platforms to ensure smooth and secure transactions.

Quick Commerce vs. E-commerce: Choosing the Best Fit for Your Business

Delivery Time: Speed vs. Flexibility

E-commerce usually offers regular shipping in 1-7 days and expedited shipping in 1-3 days. Some platforms offer same-day delivery in large cities, though this is not yet the norm.

Quick commerce, by contrast, is built for speed, promising delivery in 10-30 minutes, rarely exceeding two hours. It leverages dark stores and couriers on bicycles or scooters to ensure rapid last-mile delivery, especially in cities. This model is expanding beyond metros into Tier 2 and Tier 3 cities, meeting the growing demand for instant grocery delivery.

Quick commerce suits urgent, local needs for businesses, while e-commerce offers flexibility for broader markets. Customers prioritizing speed will lean toward Q-commerce, while those seeking variety may tolerate longer waits.

Product Range: Variety vs. Essentials

E-commerce shines with its vast product range, often stocking millions of SKUs across categories like electronics, fashion, and home goods. It includes essentials, non-essentials, and niche items, with platforms like Amazon hosting multiple brands and sellers.

Quick commerce takes a curated approach, offering 1,000-5,000 SKUs focused on fast-moving goods like groceries, personal care, and over-the-counter medications. Its inventory focuses on essentials, offering convenience rather than a wide selection. While some platforms include electronics, the focus remains on daily essentials.

Businesses choosing e-commerce can cater to diverse tastes, while quick commerce is ideal for high-demand, everyday items. Shoppers needing variety will prefer e-commerce, but those wanting quick essentials gravitate toward Q-commerce.

Inventory Management: Scale vs. Precision

E-commerce relies on centralized warehouses to store vast inventories. Advanced systems track stock across multiple locations, using predictive analytics to forecast demand and manage slow-moving items. This scale allows e-commerce to offer diverse products at lower storage costs.

Quick commerce uses micro-fulfillment centers or dark stores in urban areas, focusing on high-turnover items. Real-time inventory management ensures stock accuracy for rapid delivery, with data analytics predicting local demand. Limited space means only high-demand items are stocked, optimizing efficiency.

For businesses, e-commerce’s large-scale inventory suits broad markets, while quick commerce’s precise, local approach supports fast delivery.

Technology Focus: Scalability vs. Speed

E-commerce platforms prioritize seamless browsing and purchasing. They invest in personalization algorithms for tailored recommendations, robust search and filtering tools, and complex logistics for order tracking. E-commerce application development focuses on scalability to handle high traffic and diverse catalogs.

Quick commerce, which includes online food ordering apps, is focused on speed-driven tech. Route optimization algorithms ensure fast delivery, while real-time inventory systems maintain stock accuracy. Location-based tech enables precise deliveries; intuitive apps support quick ordering and live tracking. Quick commerce app development is all about speeding up the process.

Businesses building e-commerce platforms need scalable systems, while quick commerce demands real-time, location-focused tech.

Customer Experience: Comprehensive vs. Convenient

E-commerce has enriched the shopping experience with extensive product descriptions, ratings and comparisons. It supports diverse payment options, including installments, and provides multiple customer service channels, though responses may not be immediate. Returns often involve shipping items back, which can be complex.

Quick commerce prioritizes convenience, offering minimal product details for faster checkouts. Payment choices are basic to maximize speed, and some platforms allow for real-time chat with delivery people. Returns are often handled instantly via couriers, enhancing the customer experience in Q-commerce.

Customers seeking depth and variety prefer e-commerce, while those valuing speed choose quick commerce. Businesses must align their model with customer priorities.

Business Model and Profitability: Scale vs. Frequency

E-commerce achieves profitability through economies of scale, operating on thin margins but high volumes. It may generate revenue from marketplace fees or advertising, leveraging centralized warehouses for cost efficiency.

Due to decentralized fulfillment and rapid delivery, quick commerce faces higher costs. It offsets this with premium prices or delivery fees, relying on frequent orders and customer loyalty for sustainability. Reaching profitability may take longer in sparsely populated regions or during the early growth phase.

Businesses with global ambitions may prefer e-commerce’s scalable model, while those targeting urban, repeat customers can leverage quick commerce’s high-frequency approach.

Dark Stores vs. Large Warehouses

The logistics backbone defines these models. Dark stores are small, urban facilities stocked with essentials, enabling rapid delivery. They use real-time systems to ensure stock availability but limit variety due to space constraints.

Large warehouses, used by e-commerce, store millions of items for cost efficiency. Located in suburban areas, they support diverse inventories but increase delivery times.

Choose dark stores for fast, local service or large warehouses for broad, cost-effective operations.

Technology Powering Quick Commerce and E-commerce

Both models rely on cutting-edge technology, but their approaches differ significantly.

E-commerce Technology

Creating an e-commerce platform demands robust e-commerce application development to ensure a seamless and scalable user experience. Essential features include:

- Seamless payment gateway integration: Supports multiple payment methods like credit cards, digital wallets, and BNPL (Buy Now, Pay Later).

- Product recommendation engines: Use AI to suggest items based on user behavior.

- Scalable infrastructure: Handles millions of SKUs and global shipping logistics.

E-commerce platforms also invest in real-time inventory management to track stock across e-commerce centralized warehouses. However, their focus is on scalability rather than speed, which can lead to delays during peak seasons.

Quick Commerce Technology

Q-commerce thrives on speed and precision, powered by:

- Grocery delivery app development: Apps like DoorDash or Blinkit prioritize intuitive interfaces and fast checkouts.

- Route optimization algorithms: AI-driven systems calculate the fastest delivery routes, minimizing transit time.

- Real-time order tracking apps: Customers can monitor their orders in real time, boosting trust and transparency.

- Real-time inventory management: Ensures dark stores are stocked with high-demand items, reducing out-of-stock scenarios.

Quick commerce’s tech stack is leaner but laser-focused on hyper-local efficiency, making it ideal for urban markets.

Real-World Examples: Quick Commerce Speed vs. E-commerce Scale

To understand quick commerce vs e-commerce, let’s compare real-world examples that highlight their strengths and differences:

Impact of Quick Commerce on Traditional E-commerce

The rise of quick commerce has significantly disrupted the traditional ecommerce business model, forcing platforms to adapt to new consumer demands. Here’s how quick commerce is reshaping e-commerce:

Shift in Consumer Expectations

Quick commerce has set a new benchmark for speed, making 2–3 day deliveries feel outdated. Platforms like Amazon have responded with services like Amazon Fresh, offering same-day delivery for perishables. Customer experience in Q-commerce emphasizes instant gratification, pushing e-commerce to accelerate logistics.

Logistics Overhaul

To compete, e-commerce giants are investing in micro-fulfillment centers and route optimization algorithms. For instance, Flipkart Quick now delivers essentials in 90 minutes, inspired by quick commerce business model pioneers like Blinkit.

Adoption of Hyperlocal Models

E-commerce platforms are integrating dark stores to reduce delivery times for high-demand items. BigBasket’s BB Now, for instance, adopts the hyperlocal approach of quick commerce, promising the delivery of groceries within 15–30 minutes.

Rising Customer Acquisition Costs

Quick commerce platforms like Zepto have loyal urban customers due to their speed-focused USP. To retain market share, e-commerce platforms are spending more on marketing, loyalty programs, and subscription models, increasing customer acquisition costs.

Product Category Shifts

Quick commerce dominates essentials like groceries and FMCG, while e-commerce retains leadership in non-urgent categories like electronics and fashion. This has led e-commerce platforms to diversify into hybrid models, balancing speed and variety.

Increased Competition

The growth of quick commerce app development has fragmented the market, with platforms like Swiggy Instamart diverting customers from Amazon for daily essentials. This intensifies competition, pushing innovation across both models.

Hybrid Models Emerge

To bridge quick commerce vs e-commerce, platforms like Amazon Fresh and Flipkart Quick combine express delivery for essentials with traditional e-commerce for non-urgent goods. This hybrid approach caters to diverse consumer needs.

Conclusion

Conventional ecommerce stalwarts are noticing this and frantically building their own quick commerce app in order not to be left behind.

Critics may contend that such speedy delivery is not sustainable or unaffordable. Nevertheless, rising technological efficiencies and consumer willingness to pay modest premium charges are quickly alleviating those concerns. The market is voting with its wallet and quick commerce is prevailing.

What the future holds, however, is clear: this rapid retailing isn’t merely a trend—rather, it’s a redefining of retail at its core. Current e-commerce has little choice but to adapt or be reduced to a bygone era of slower, less interconnected retailing.

It’s practical for business decisions but could address Q-commerce sustainability more and balance its pro-Q-commerce tone. A solid retail guide.